kondulaynen.ru Categories

Categories

Adaptive Moving Average

Adaptive Moving Average The adaptive moving average indicator is shown as a single line on the chart. It is a moving average line that adapts to the. Unlike traditional moving averages that use a fixed time period for calculation, the AMA adjusts its sensitivity based on the volatility of the underlying asset. The adaptive moving average (KAMA) is a moving average designed to account for changes in market volatility. The indicator closely follows prices when the price. The Adaptive Exponential Moving Average (EMA) is a modified version of the traditional EMA. Unlike the conventional EMA, which applies a. The Adaptive Moving Average is an innovative technical analysis tool that uses a moving average to smooth past data and detect short-term trends. The Kaufman Adaptive Moving Average was created, not surprisingly, by Perry Kaufman. The KAMA takes into consideration the noise of the market. This version of. When traders use Kaufman's Adaptive Moving Average indicator, they get a clear picture of the market's behavior, which they can use to make trading decisions. This blog post will go over what Kaufman's Adaptive Moving Average (KAMA) is and how it works based on that paper. The Kaufman Adaptive Moving Average (KAMA) is a technical analysis indicator developed by the American quantitative financial theorist Perry J. Kaufman in. Adaptive Moving Average The adaptive moving average indicator is shown as a single line on the chart. It is a moving average line that adapts to the. Unlike traditional moving averages that use a fixed time period for calculation, the AMA adjusts its sensitivity based on the volatility of the underlying asset. The adaptive moving average (KAMA) is a moving average designed to account for changes in market volatility. The indicator closely follows prices when the price. The Adaptive Exponential Moving Average (EMA) is a modified version of the traditional EMA. Unlike the conventional EMA, which applies a. The Adaptive Moving Average is an innovative technical analysis tool that uses a moving average to smooth past data and detect short-term trends. The Kaufman Adaptive Moving Average was created, not surprisingly, by Perry Kaufman. The KAMA takes into consideration the noise of the market. This version of. When traders use Kaufman's Adaptive Moving Average indicator, they get a clear picture of the market's behavior, which they can use to make trading decisions. This blog post will go over what Kaufman's Adaptive Moving Average (KAMA) is and how it works based on that paper. The Kaufman Adaptive Moving Average (KAMA) is a technical analysis indicator developed by the American quantitative financial theorist Perry J. Kaufman in.

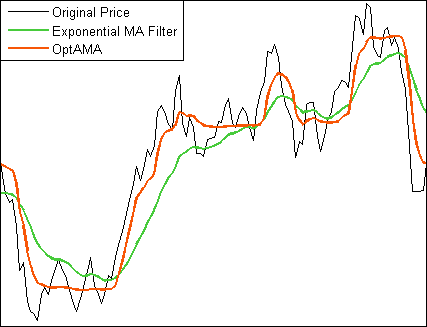

The Adaptive Moving Average (AMA) Signals indicator, enhances the classic concept of moving averages by making them adaptive to the market's volatility. Our backtests show that a simple moving average can be used profitably for both mean-reversion and trend-following strategies on stocks. The KAMA is designed to provide traders with a more accurate moving average by adapting to changes in market volatility and price action. The Kaufman Adaptive Moving Average tries to adjust it's smoothing to match the current market condition. It adapts to a fast moving average when prices are. An Adaptive Moving Average (AMA) is another indicator like SMA, MMA and EMA, but has more parameters. It changes its sensitivity due to the price fluctuations. The Adaptive Moving Average, developed by Perry Kaufman, adapts to market dynamics. Traditional moving averages often fail to balance responsiveness and. This indicator, an adaptive moving average (AMA), moves very slowly when markets are moving sideways but moves swiftly when the markets also move swiftly. The Kaufman Adaptive Moving Average (KAMA) is a versatile moving average indicator that adjusts its sensitivity based on market conditions. Developed by Perry Kaufman, Kaufman's Adaptive Moving Average is designed to act as an MA, while also tracking the degree of noise in the trend and. Adaptive Moving Average. Adaptive moving average (AMA), as the name suggests is an adaptation of moving average. It is designed to adapt according to the. The MESA Adaptive Moving Average (MAMA) is a technical analysis indicator that is designed to respond to changing market conditions and reduce lag in trend. The Cong Adaptive Moving Average is a technical indicator designed to respond to price changes in volatile markets. This indicator is like ordinary moving average indicator. I compared 9 period AMA with 9 period EMA. Here is the result. AMA is more stable than EMA. The Adaptive Moving Average is a technical indicator that is designed to become less sensitive to price movement when it is range-bound or volatile and more. The adaptive moving average moves slowly when prices are moving sideways and moves swiftly when prices move swiftly. The basic rule is to buy when the AMA. The AMA study is like the exponential moving average (EMA), except the AMA uses a scalable constant instead of a fixed constant for smoothing the data. The AdaptiveMovAvg series function calculates an adaptive moving average based on a variable speed exponential moving average. The Kaufman's Adaptive Moving Average (KAMA) is a technical indicator used in trading to reduce the lagging effect of traditional moving averages. It adjusts to. This indicator computes the Kaufman Adaptive Moving Average (KAMA). The Kaufman Adaptive Moving Average is calculated as explai. An Adaptive Moving Average (AMA) is one more moving average overlay, just like Exponential Moving Average. It changes its sensitivity to price fluctuations.